Who Qualifies For Maine Homestead Property Tax Exemption . You must check all three boxes to qualify for the maine. augusta, maine — mainers 65 and older can soon qualify for a new form of property tax relief. the homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. Check the appropriate box related to each question. Here's what you need to know about it. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. the maine homestead exemption may lower your property tax bill. It makes it so the town won't count $25,000 of value of your. The property owner must be enrolled in the homestead exemption act for at least 10 years. the homestead exemption is available to any qualified maine resident who applies with their local town office.

from www.templateroller.com

the maine homestead exemption may lower your property tax bill. It makes it so the town won't count $25,000 of value of your. Check the appropriate box related to each question. You must check all three boxes to qualify for the maine. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. Here's what you need to know about it. The property owner must be enrolled in the homestead exemption act for at least 10 years. the homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. the homestead exemption is available to any qualified maine resident who applies with their local town office. augusta, maine — mainers 65 and older can soon qualify for a new form of property tax relief.

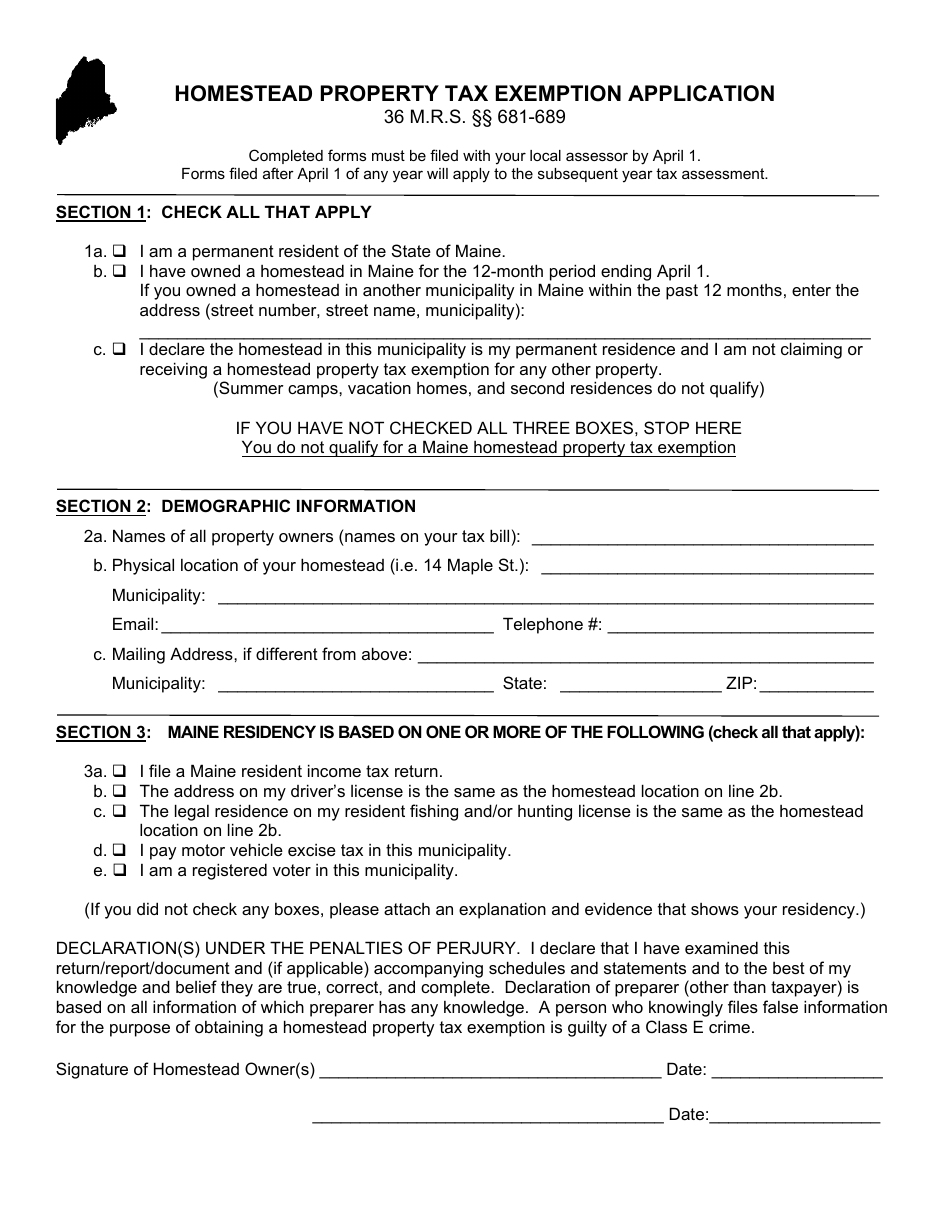

Maine Homestead Property Tax Exemption Application Fill Out, Sign

Who Qualifies For Maine Homestead Property Tax Exemption The property owner must be enrolled in the homestead exemption act for at least 10 years. You must check all three boxes to qualify for the maine. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. Here's what you need to know about it. the homestead exemption is available to any qualified maine resident who applies with their local town office. It makes it so the town won't count $25,000 of value of your. augusta, maine — mainers 65 and older can soon qualify for a new form of property tax relief. Check the appropriate box related to each question. the maine homestead exemption may lower your property tax bill. the homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. The property owner must be enrolled in the homestead exemption act for at least 10 years.

From exoczjfgc.blob.core.windows.net

Who Qualifies For Homestead Exemption In Nc at Mickey Carroll blog Who Qualifies For Maine Homestead Property Tax Exemption the maine homestead exemption may lower your property tax bill. Here's what you need to know about it. It makes it so the town won't count $25,000 of value of your. augusta, maine — mainers 65 and older can soon qualify for a new form of property tax relief. in maine, “the just value of $10,000 of. Who Qualifies For Maine Homestead Property Tax Exemption.

From ceohfevp.blob.core.windows.net

How Do You Apply For The Homestead Exemption at Robin Bradley blog Who Qualifies For Maine Homestead Property Tax Exemption Here's what you need to know about it. It makes it so the town won't count $25,000 of value of your. the homestead exemption is available to any qualified maine resident who applies with their local town office. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned. Who Qualifies For Maine Homestead Property Tax Exemption.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson Who Qualifies For Maine Homestead Property Tax Exemption augusta, maine — mainers 65 and older can soon qualify for a new form of property tax relief. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. the homestead exemption provides a reduction of up to $25,000 in the value of your. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.formsbank.com

Application For Homestead Property Tax Exemption Form printable pdf Who Qualifies For Maine Homestead Property Tax Exemption the homestead exemption is available to any qualified maine resident who applies with their local town office. augusta, maine — mainers 65 and older can soon qualify for a new form of property tax relief. The property owner must be enrolled in the homestead exemption act for at least 10 years. Check the appropriate box related to each. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.youtube.com

Homestead Exemption & Property Taxes, explained. YouTube Who Qualifies For Maine Homestead Property Tax Exemption Here's what you need to know about it. Check the appropriate box related to each question. the homestead exemption is available to any qualified maine resident who applies with their local town office. It makes it so the town won't count $25,000 of value of your. You must check all three boxes to qualify for the maine. augusta,. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Property Tax Exemption Application for Legally Blind Persons Who Qualifies For Maine Homestead Property Tax Exemption Here's what you need to know about it. the homestead exemption is available to any qualified maine resident who applies with their local town office. the maine homestead exemption may lower your property tax bill. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Homestead Property Tax Exemption Application Fill Out, Sign Who Qualifies For Maine Homestead Property Tax Exemption You must check all three boxes to qualify for the maine. Here's what you need to know about it. The property owner must be enrolled in the homestead exemption act for at least 10 years. It makes it so the town won't count $25,000 of value of your. the maine homestead exemption may lower your property tax bill. Check. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Property Tax Exemption Application for Veterans of the Armed Who Qualifies For Maine Homestead Property Tax Exemption It makes it so the town won't count $25,000 of value of your. Here's what you need to know about it. the homestead exemption is available to any qualified maine resident who applies with their local town office. augusta, maine — mainers 65 and older can soon qualify for a new form of property tax relief. the. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.sprouselaw.com

Qualifying Trusts for Property Tax Homestead Exemption Sprouse Who Qualifies For Maine Homestead Property Tax Exemption The property owner must be enrolled in the homestead exemption act for at least 10 years. Here's what you need to know about it. the maine homestead exemption may lower your property tax bill. Check the appropriate box related to each question. in maine, “the just value of $10,000 of the homestead of a permanent resident of this. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Property Tax Deferral Application for an OwnerOccupied Homestead Who Qualifies For Maine Homestead Property Tax Exemption You must check all three boxes to qualify for the maine. the maine homestead exemption may lower your property tax bill. Check the appropriate box related to each question. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. It makes it so the. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Homestead Property Tax Exemption Application for Cooperative Who Qualifies For Maine Homestead Property Tax Exemption the homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. Here's what you need to know about it. Check the appropriate box related to each question. It makes it so the town won't count $25,000 of value of your. You must check all three boxes to qualify for the. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Application for Maine Homestead Property Tax Exemption for Who Qualifies For Maine Homestead Property Tax Exemption the homestead exemption provides a reduction of up to $25,000 in the value of your home for property tax purposes. Here's what you need to know about it. It makes it so the town won't count $25,000 of value of your. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Application for Maine Homestead Property Tax Exemption Fill Out Who Qualifies For Maine Homestead Property Tax Exemption the homestead exemption is available to any qualified maine resident who applies with their local town office. It makes it so the town won't count $25,000 of value of your. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. the maine homestead. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

Maine Property Tax Deferral Application for an OwnerOccupied Homestead Who Qualifies For Maine Homestead Property Tax Exemption It makes it so the town won't count $25,000 of value of your. You must check all three boxes to qualify for the maine. in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. the homestead exemption is available to any qualified maine resident. Who Qualifies For Maine Homestead Property Tax Exemption.

From my-unit-property-3.netlify.app

Homestead Property Tax Assessments Who Qualifies For Maine Homestead Property Tax Exemption You must check all three boxes to qualify for the maine. The property owner must be enrolled in the homestead exemption act for at least 10 years. the maine homestead exemption may lower your property tax bill. Here's what you need to know about it. It makes it so the town won't count $25,000 of value of your. . Who Qualifies For Maine Homestead Property Tax Exemption.

From www.firsthomehouston.com

How to Apply for Your Homestead Exemption Plus Q and A — First Home Who Qualifies For Maine Homestead Property Tax Exemption Here's what you need to know about it. the homestead exemption is available to any qualified maine resident who applies with their local town office. Check the appropriate box related to each question. The property owner must be enrolled in the homestead exemption act for at least 10 years. augusta, maine — mainers 65 and older can soon. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.lendingtree.com

What Is a Homestead Exemption and How Does It Work? LendingTree Who Qualifies For Maine Homestead Property Tax Exemption in maine, “the just value of $10,000 of the homestead of a permanent resident of this state who has owned a homestead in this. It makes it so the town won't count $25,000 of value of your. You must check all three boxes to qualify for the maine. The property owner must be enrolled in the homestead exemption act. Who Qualifies For Maine Homestead Property Tax Exemption.

From www.templateroller.com

2023 Maine Municipal Property Tax Report on Deferred Homestead Taxes Who Qualifies For Maine Homestead Property Tax Exemption It makes it so the town won't count $25,000 of value of your. Here's what you need to know about it. the maine homestead exemption may lower your property tax bill. The property owner must be enrolled in the homestead exemption act for at least 10 years. Check the appropriate box related to each question. You must check all. Who Qualifies For Maine Homestead Property Tax Exemption.